By Michaela Helean / NM News Port

A pandemic-related coin shortage and other factors are pushing more businesses to reject cash in favor of accepting only debit and credit cards, but some customers are reluctant to give up on bills and coins.

The coin shortage is a circulation problem, according to the U.S. Federal Reserve. The U.S. Mint produced 14.8 billion coins in 2020 and 11.9 billion in 2019—plenty, it says—but bank shutdowns and reduced consumer spending resulted in fewer coins changing hands.

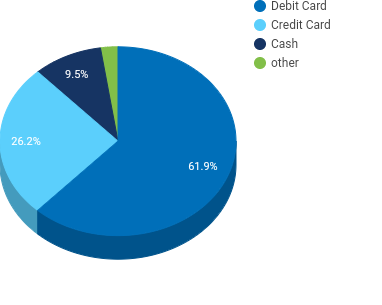

For several years consumer use of credit cards has gone up while the use of cash has gone down, according to a survey by the U.S. Bank. Debit cards remain the most popular form of payment.

Brandon Vasquez, 20, said he likes to carry a debit card because it’s just one thing, whereas cash involves too many items for him to keep track of. Also, he said, “I use a debit card because it is easy. Money is messy.”

During the pandemic, cash became a concern for transmitting the virus and last year the CDC recommended that businesses encourage the use of touchless payment options. (Since then we’ve learned that COVID-19 is mostly spread through the air and not surfaces, so the CDC no longer advises against cash.)

Vasquez is one of many who don’t like to carry cash. The Federal Reserve says much of the country’s currency is sitting around people’s houses, unused. Earlier this year the Fed launched the U.S. Coin Task Force to encourage Americans to use more of the $48.5 billion in coins that are already in circulation.

“The weak circulation affects most everyone, but the hardest hit are small, cash-dependent businesses and those who are least well off,” Task Force member Hannah L. Walker said in a press release.

The Task Force recommends that people start spending coins, deposit them in bank accounts or redeem them at coin kiosks in order to, as their hashtag suggests #getcoinmoving.

Moriah Marshall, 19 and a student at CNM, doesn’t need to be persuaded. She said she prefers cash because she’s afraid of identity theft. “I don’t use a card because I am afraid I will lose it,” she said. Using cash makes it easy to control her spending, she added.

Michaela Helean is a reported for New Mexico News Port and can be reached on twitter @MichaelaHelean